adip elit, Powered by Spericorn

dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s

Please have a demo

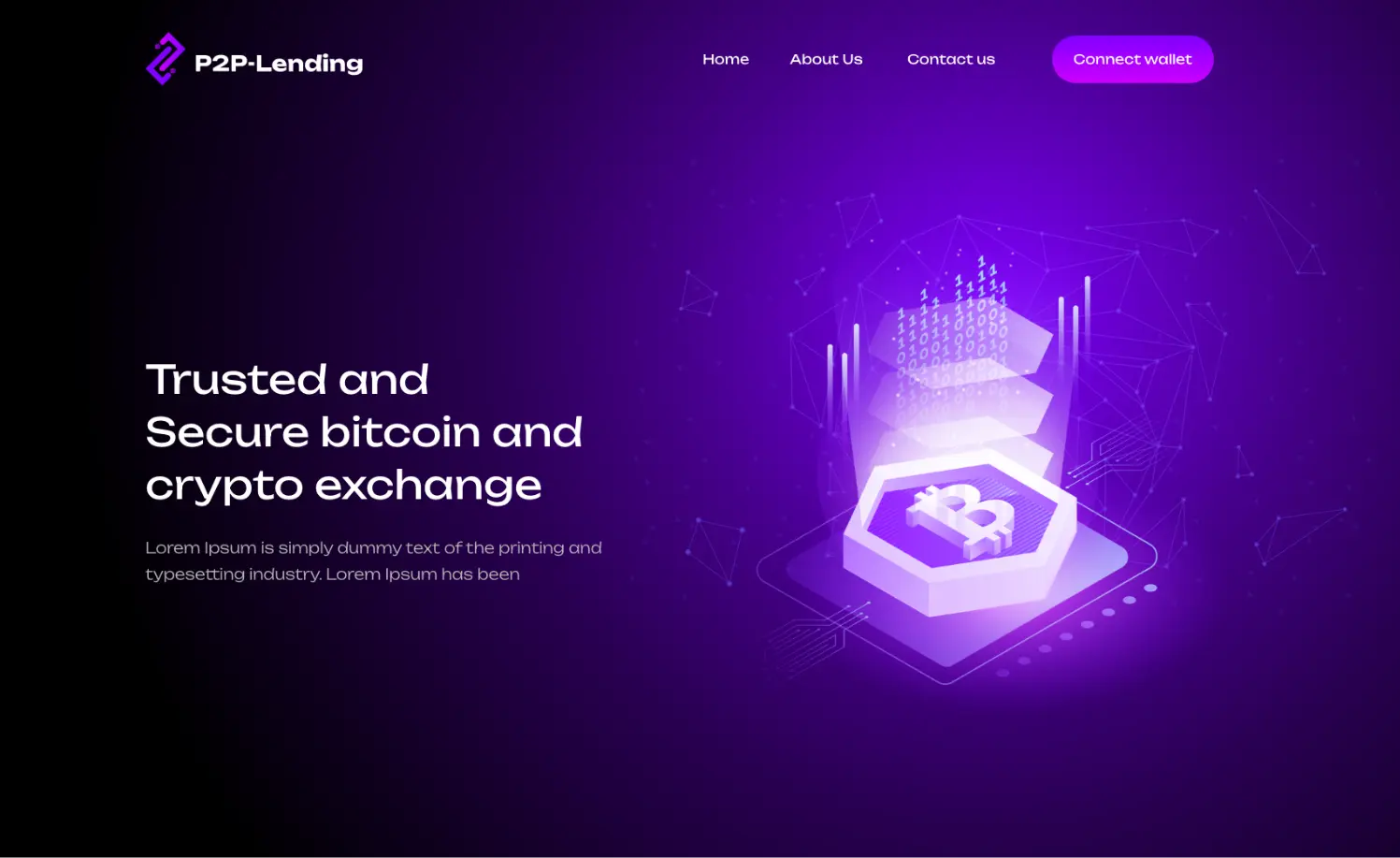

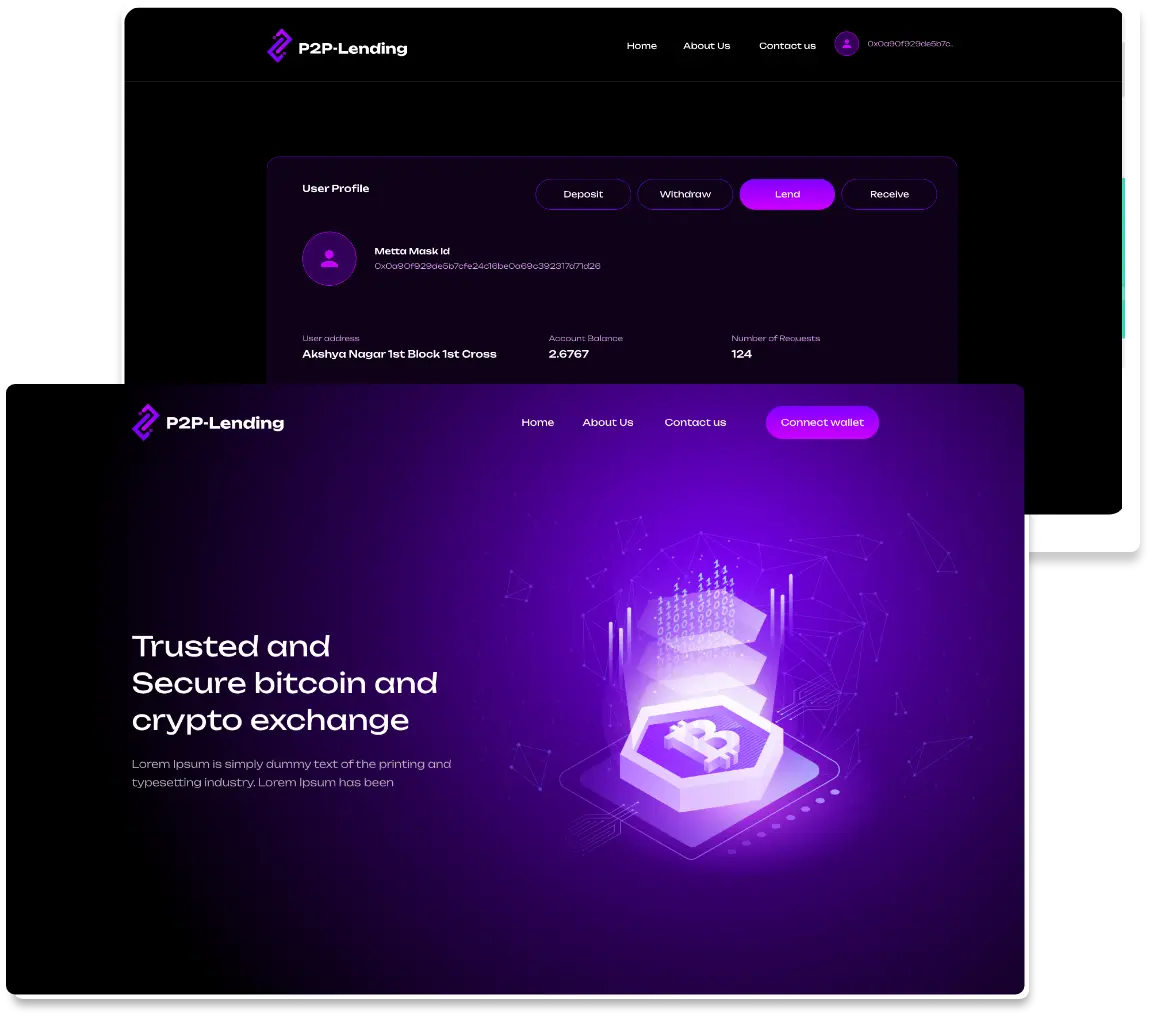

In the rapidly evolving world of finances, Peer-to-Peer (P2P) lending has become a popular alternative to traditional borrowing and lending. With the advent of blockchain technology, P2P lending has become more efficient, transparent, and secure.

One platform that has leveraged the potential of blockchain is the P2P-Lending platform developed by Spericorn technology. This platform is designed to make lending and borrowing cryptocurrencies easy and accessible to everyone without intermediaries. Let’s delve deeper into this innovative platform’s user-friendly features and functionalities and an overview of the P2P lending landscape.

The P2P landing page features four primary icons: Home, About Us, Contact Us, and Connect Wallet. This home page displays a concise summary of the platform and its standout features. Additionally, it provides an option to the users to reach out to the P2P team for further assistance.

The about us panel provides a detailed description of the platform, including its operation without third-party intermediaries. It also includes customer testimonials and a FAQ section that answers common questions about the platform. The help desk is available 24/7 to provide personal assistance.

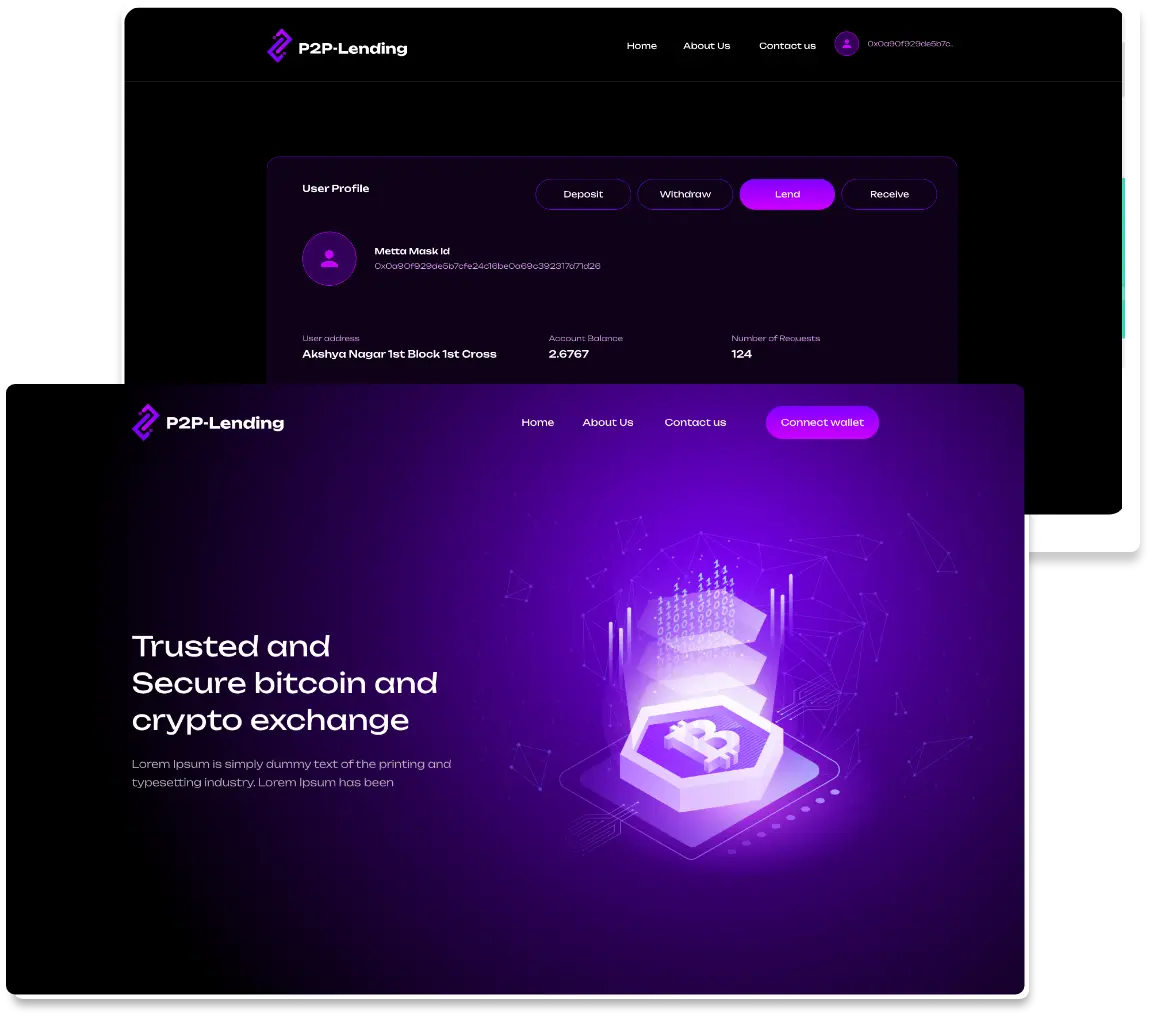

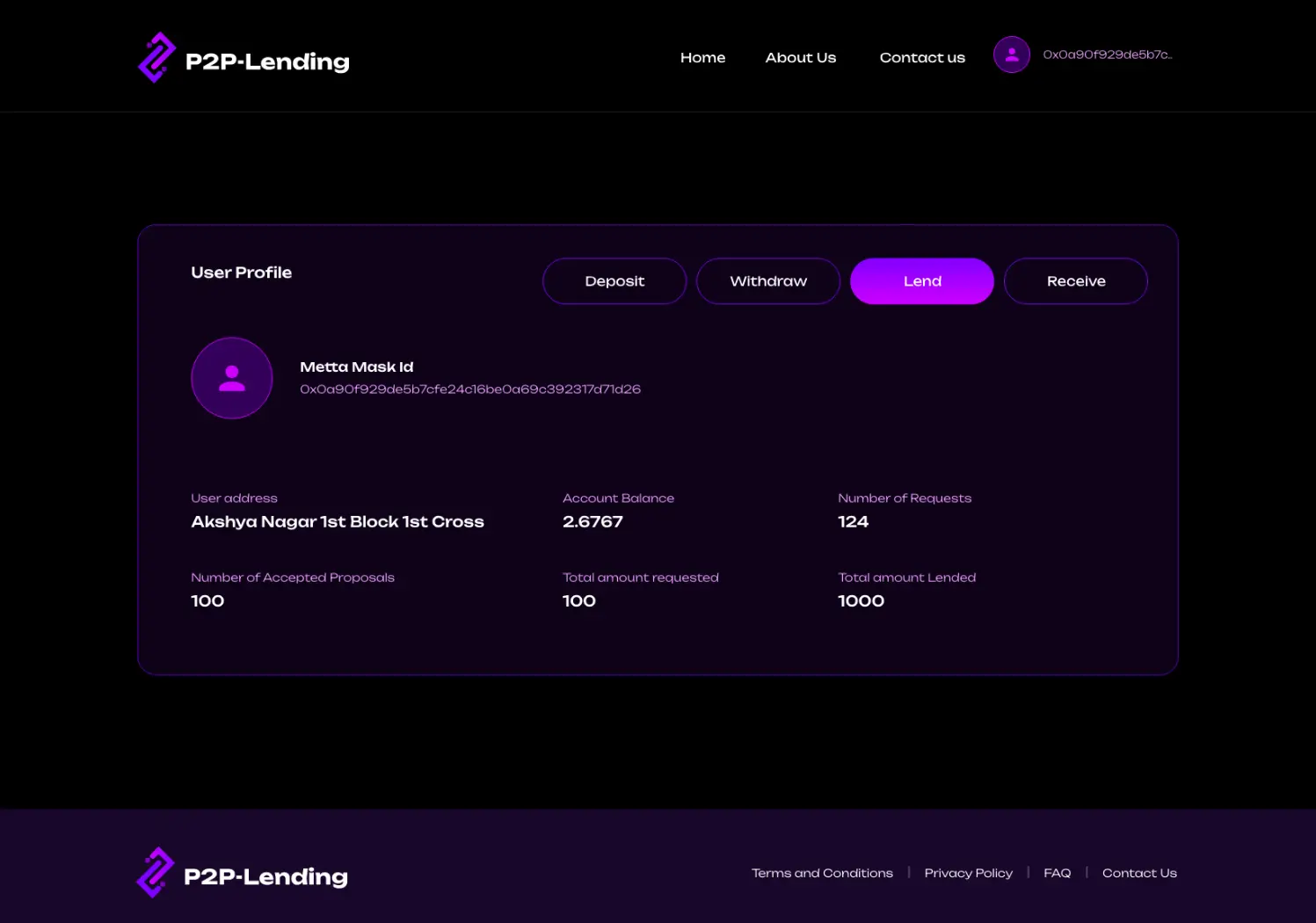

Users need to connect their wallet using their Metamask address to create a user profile. This gives them access to their user profile page, which publicly displays their unique Metamask address and other details such as the number of requests, accepted proposals, the total amount requested, and wallet balance.

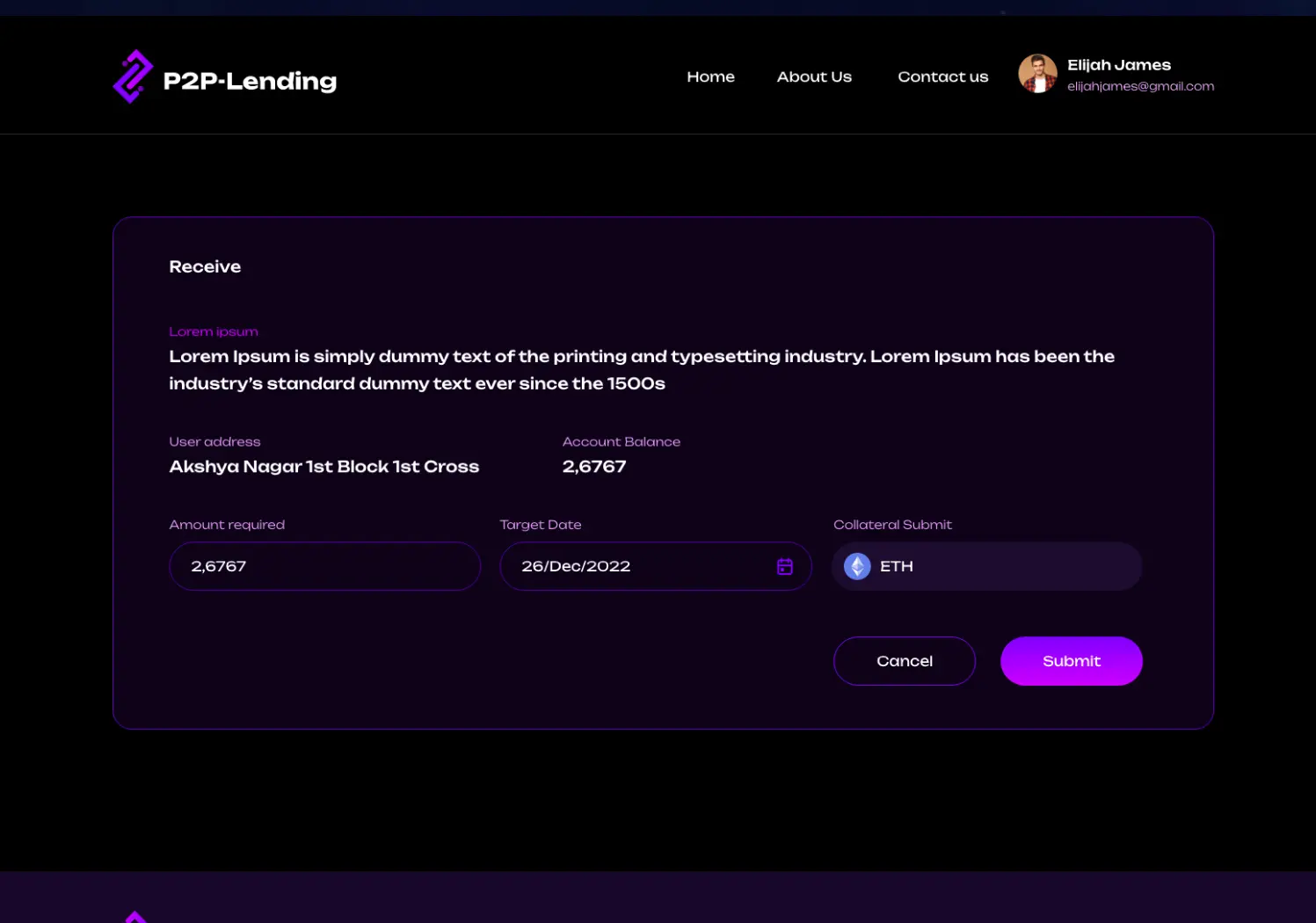

Users must navigate to the Borrow page on their user profile to request a loan. The page provides clear instructions on borrowing, including that users can borrow up to 80% of their deposited collateral. Interest rates are calculated daily, and the maximum permissible interest rate is 0.1%.

Users must have a collateral balance to be eligible for borrowing, and the amount they can borrow is based on their collateral balance. Once the user enables borrowing, they can set a target date for repaying the loan and fix the interest rate to their convenience. The page also allows users to monitor their loans, including those that are active and those that have been requested.

When users submit a loan request on the P2P lending platform, they receive a timely status update, including a unique transaction hash generated by the blockchain, block confirmation, request status, and submission time.

The platform also provides wallet address details and displays the Ethereum value, transaction fee in dollars, and gas price for transparency. Canceling a loan request is effortless with a single click of the cancel button, which triggers Metamask to initiate payment of the gas fee.

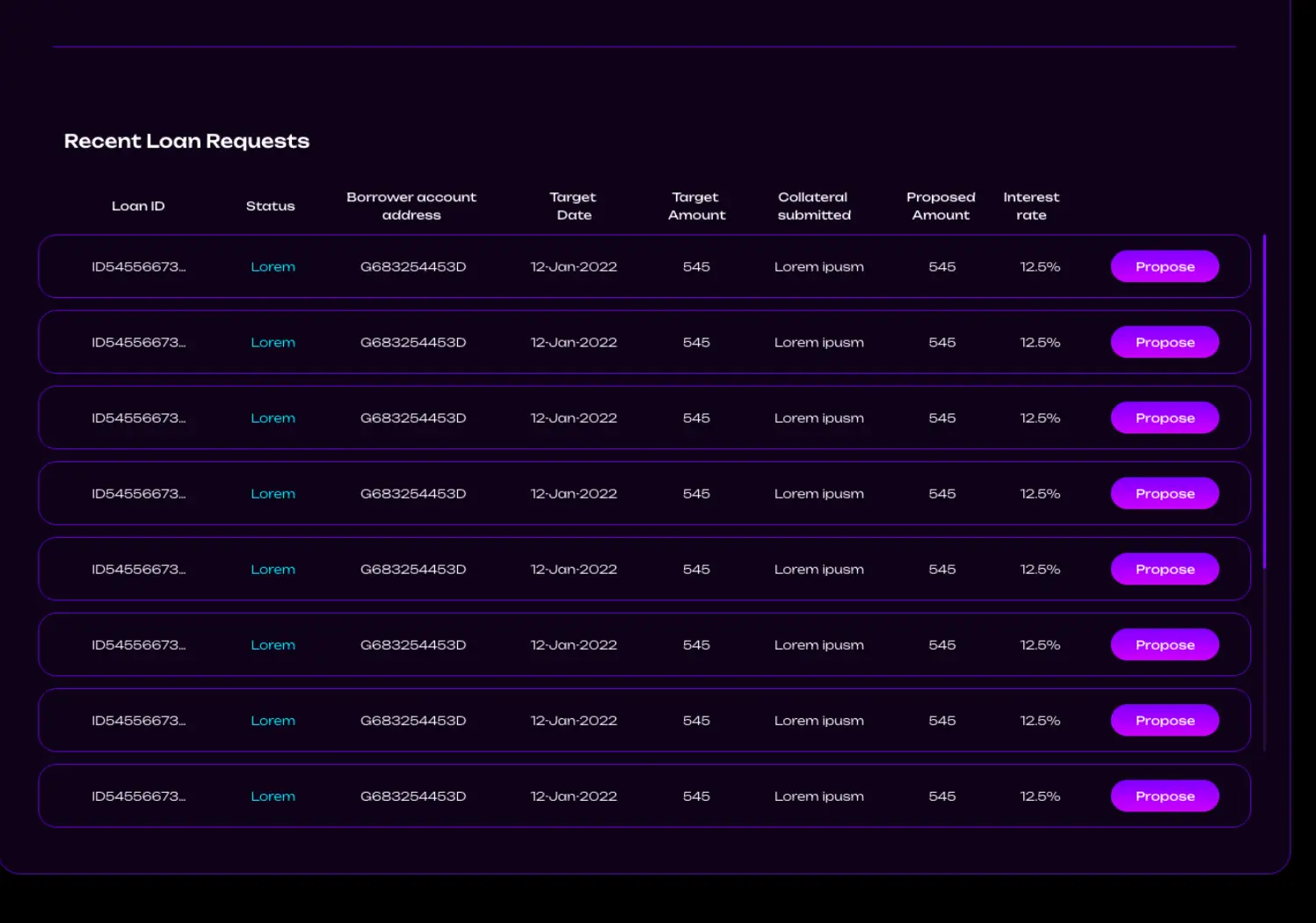

When a lender accesses the Lend page, they are presented with a list of loan requests made by borrowers. This list includes critical details such as the loan ID, borrower account address, the due date locked in by the borrower, the amount requested, and the interest rate the borrower is willing to pay.

If the lender is satisfied with the loan terms and decides to accept the loan, they can do so by clicking the lend button. This action triggers Metamask to initiate the payment, facilitating a smooth and hassle-free lending experience.

Once a lender approves a loan request, the loan is moved to the Active Loans panel. In this panel, borrowers can see a list of their active loans, including the daily interest rate and a button to initiate repayment.

It is important to note that if a borrower fails to deposit the loan amount on the specified due date, the collateral amount will automatically be sent to the lender. This streamlined process helps facilitate lending and borrowing on the P2P platform, creating a mutually beneficial situation for all parties involved.

dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s

Please have a demo

Spericorn Technology’s P2P lending platform offers a range of unique and user-friendly features that make it an innovative and trustworthy platform for lending and borrowing cryptocurrencies. The platform’s transparency and scalability are critical features that give users complete visibility over their transactions.

Users are provided with regular status updates containing vital information, which makes the platform easily manageable. The platform’s decentralized and trustless nature ensures that users can transact without intermediaries, making it an efficient and cost-effective solution for users.